sales tax in san antonio texas calculator

2022 cost of living calculator for taxes. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara.

Tax Agency San Antonio Tx Bookkeepers Consultant Inc

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

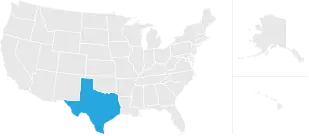

. The Texas state sales tax rate is currently 625. The December 2020 total local sales tax rate was also 8250. How to Calculate Sales Tax.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as.

Sales tax in San Antonio Texas is currently 825. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. This is the total of state and county sales tax rates.

City of San Antonio Attn. Before-tax price sale tax rate and final or after-tax price. The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio.

San Antonio collects the maximum legal local sales tax. Sales tax is calculated by multiplying the. The minimum combined 2022 sales tax rate for Bexar County Texas is 825.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. The minimum combined 2021 sales tax rate for San Antonio. This is the total of state county and city sales tax rates.

While texas statewide sales tax rate is a relatively modest 625 total sales taxes. You can find more tax rates and. What is the sales tax rate in San Antonio Texas.

Sales Tax Calculator. Sales Tax State Local Sales Tax on Food. PersonDepartment.

And all states differ. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. San Antonio has parts of it.

SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes. Thats why we came up with this handy Texas sales tax calculator. San Antonio TX 78205.

The average cumulative sales tax rate in San Antonio. 0250 san antonio atd advanced transportation district. The current total local sales tax rate in San Antonio TX is 8250.

Calculator for Sales Tax in the San Antonio. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Counties cities and districts impose their own local taxes.

The average cumulative sales tax rate in San Antonio Texas is 822. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. Simply download the lookup tool and enter your state in this case Texas.

Real property tax on median home. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. San antonio taxi rates from downtown.

The minimum combined 2022 sales tax rate for San Antonio Texas is. View 7 photos of this 15 acre lot land located at Camelot Ln San Antonio TX 78264 on sale for 68000. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara.

Just enter the five-digit zip code of the. This includes the rates on the state county city and special levels. Enter your info to see your take home pay.

The minimum combined 2021 sales tax rate for san antonio texas is. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. Texas Sales Tax.

Box is strongly encouraged for all incoming mail. Add your county or city - and the tool will do the. Sales and Use Tax.

Texas has a 625 statewide sales tax rate but also. For additional information see our Call Tips and Peak Schedule webpage. US Sales Tax Texas.

Mailing Address The Citys PO. The current total local sales tax rate in san antonio tx is 8250. Multiply the price of your item or service by the tax rate.

The County sales tax rate is. There is base sales tax by Texas. Use our sales tax calculator or download a free Texas sales tax rate table by zip code.

Conroe Proposes Raising Property Tax Rates Ahead Of Next Year S State Mandated Cap Community Impact

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Is Tax Included With That A Hotel Tax And Sales Tax Guide Texas Hotel Lodging Association

5 Best Tax Services In San Antonio

Property Tax Calculator Casaplorer

Not All Property Tax Deductions Are Limited Texas Realtors

How To Figure The Amount Of Sales Tax In Texas

Texas Income Tax Calculator Smartasset

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Study Despite Having No Income Tax Texas Has 11th Highest Tax Rate In The Country San Antonio News San Antonio San Antonio Current

Are Ltd Benefits Taxable Your Guide To Disability Insurance Taxation

Texas Sales Tax Small Business Guide Truic

Texas Sales Tax Rates By City County 2022

St Louis Inno Did Your Startup Survive 2020 Now Is The Time To Take Advantage Of The Employee Retention Tax Credit

Texas Sales Tax Guide And Calculator 2022 Taxjar

San Antonio Based Tech Company Says It Can Speed Up Homeowners Ability To Protest Property Taxes San Antonio News San Antonio San Antonio Current